Get More Bang for Your Buck on Machine Tools & Equipment Purchases with Tax Reform

With so many options before the end of the year, purchasing the latest machine tools and other equipment, both new and used, is now twice as beneficial as it was before! Plus, investing in more efficient machinery that can help boost productivity is a great way to strengthen your business for the year ahead.

Under the Tax Cuts and Jobs Act passed at the end of 2017, businesses can now write off 100 percent of the cost of qualifying asset purchases for federal tax purposes through the use of bonus depreciation. Prior to tax reform, only 50 percent bonus depreciation was allowed and the remainder of the purchase was depreciated over the tax life of the asset.

Tax reform also greatly expanded the applicability of another asset write-off provision: Section 179. Using this deduction in combination with state tax treatment may be even more beneficial than 100 percent bonus depreciation in certain situations. Please consult with your tax advisor as to which expensing method is right for your business.

Act Soon to Secure 2018 Benefits

Keep in mind, in order for machinery and equipment to be deductible on 2018 calendar year taxpayer returns, the assets must be placed in service no later than December 31, 2018.

While this is a fast turnaround, many of our featured machine tool brands have quick delivery times for this exact reason at this time of year. To make sure this requirement is met before year’s end, make sure to contact us to place your orders as soon as possible!

Whether it’s taking advantage of Universal Robot’s promise to be at your door in under 12 days, TRUMPF’s “Buy 1 Tool Get Free Accessories,” plus more, you don’t want to miss out on this financial opportunity. Used equipment can also qualify, so be sure to check out our inventory of used machine tools.

Compound the Benefit with Increased Efficiency

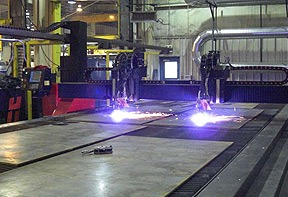

When combined with the tax benefits noted above, the increased efficiency your business will realize through faster, more accurate machine tools, will greatly compound the benefits. When you add up the value of more efficient production, less re-work, greater throughput and labor savings that today’s CNC machine tools and automated systems deliver, the cost benefit can be huge.

Contact us today to learn more about how to take advantage of Sec. 179 and tax reform benefits for your business and ask about quick-delivery machines that can be placed in service by the end of the year. We look forward to hearing from you!